Solvency II Solutions

Tabular 7.1.0.0 is available

We are pleased to inform you that we have now released the latest application and data update to Tabular.

The application update is NOT mandatory and, furthermore, the data update can be taken without upgrading the application. However, if you do take the application update you must also apply the data update (as some new features and behaviour in the new code depends on the data changes).

More details on these new features and changes are available below but, in general, the application changes relate mainly to the Standard Formula calculation module (i.e. not regulatory reporting). If you are not utilising that module or other features with changes, such as the Team Carve-out functionality, then there may not be significant value in upgrading the application.

Similarly, on the data side most changes relate to the Standard Formula module calculations but there are changes and corrections relating to QRTs and validations. The data update does include the change to inflation-index some of the fixed amounts within Sii, such as the absolute floor of the MCR, which will be applied automatically within Tabular for (EEA-based regulated insurers) returns with reference date on or after 20 October 2022.

The installation and One-click Upgrade file can be downloaded from the direct link available below (or the download page of our website).

If you do need help with this at all please do call or email our customer support team (support@solvencyiisolutions.com +44 (0) 207 193 8846).

We are here to help and support you through this process.

Thanks again for choosing to work with us.

Yours,

The SIIS Team

Direct link to upgrade files:

https://transactions.sendowl.com/orders/114006207/download/2c7721de116a6281c3fdfa74c5a3272a

One-click Upgrade instructions:

https://www.manula.com/manuals/solvency-ii-solutions/technical-guide/1/en/topic/one-click-upgrade

7.1.0.0 Release – application updates

7.1.0.0 includes several improvements to existing features as well as the introduction of some new features. The majority of feature changes are suggestions received from clients relating to the Standard Formula calculations. Please find below a list of the main changes to the standard formula module.

Calculation Formulas

To improve the traceability of the Tabular SCR calculations, and populating QRTs, Excel formulas are now included in all SCR calc results sheets and applicable QRTs.

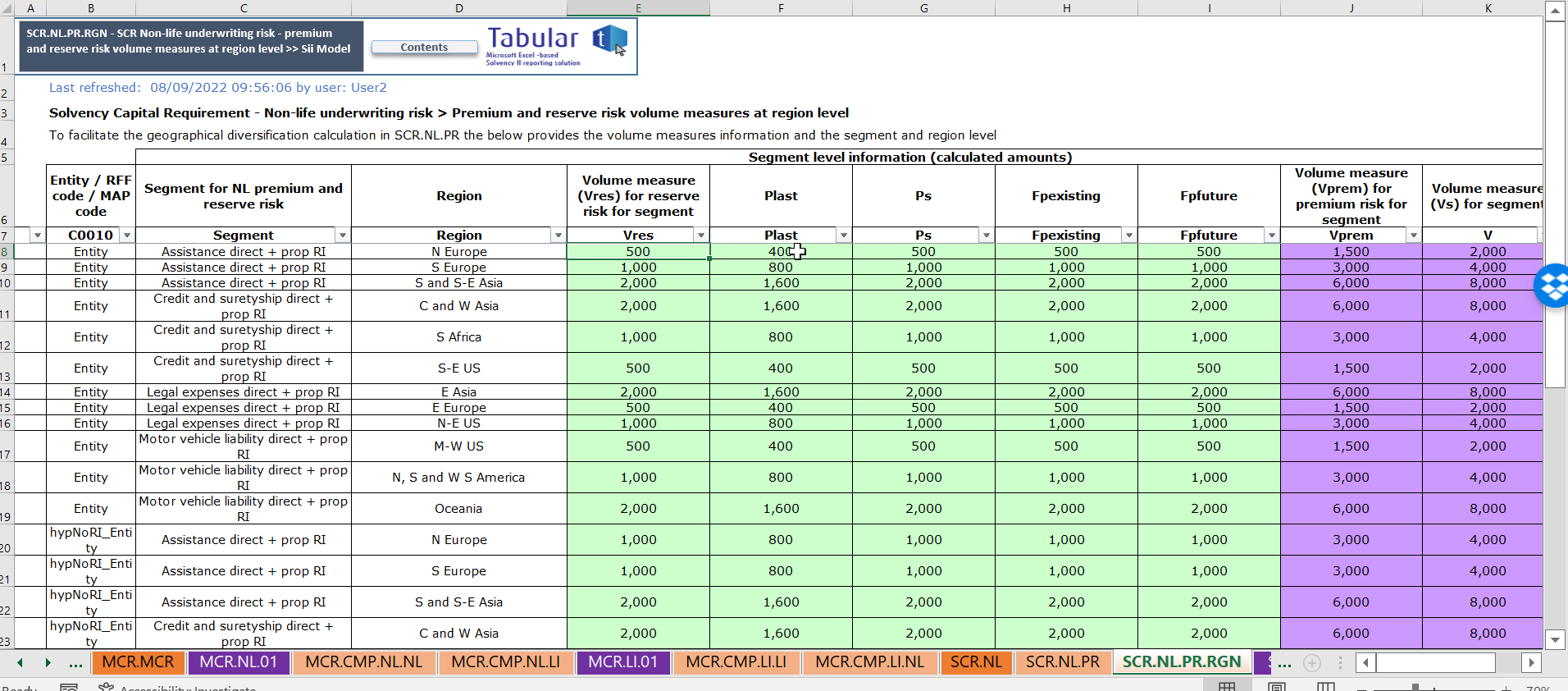

For SCR results (for example SCR.NL.PR.RGN screengrab below, which shows the non-life u/w premium and reserve risk results) users can now see every calculation step in deriving the SCR result:

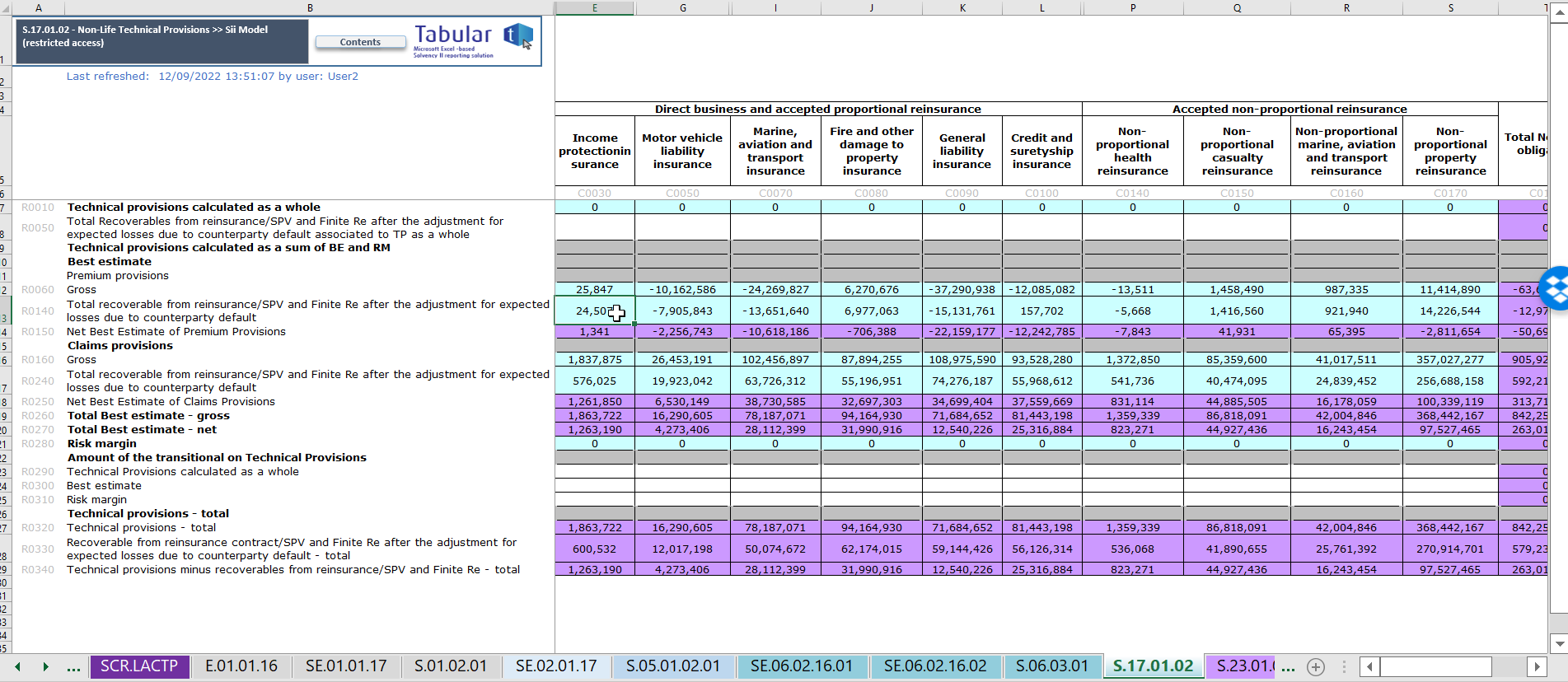

For QRTs (for example S.17.01.02 screengrab below) users can now see the link to the input data:

In the exceptional case of NAT CAT risk, the default will be to “hide” the calculations related to aggregating losses at risk zone level to produce total regional diversified loss (e.g. aggregating all windstorm losses across different UK CRESTA zones to the total UK windstorm gross SCR loss taking into account diversification across CRESTA zones); this saves a significant amount of data and formulas from the workbooks (which is difficult to trace through in practice in any case). However, should a user wish to see the underlying Excel calculation they can choose in return setup to include these sheets.

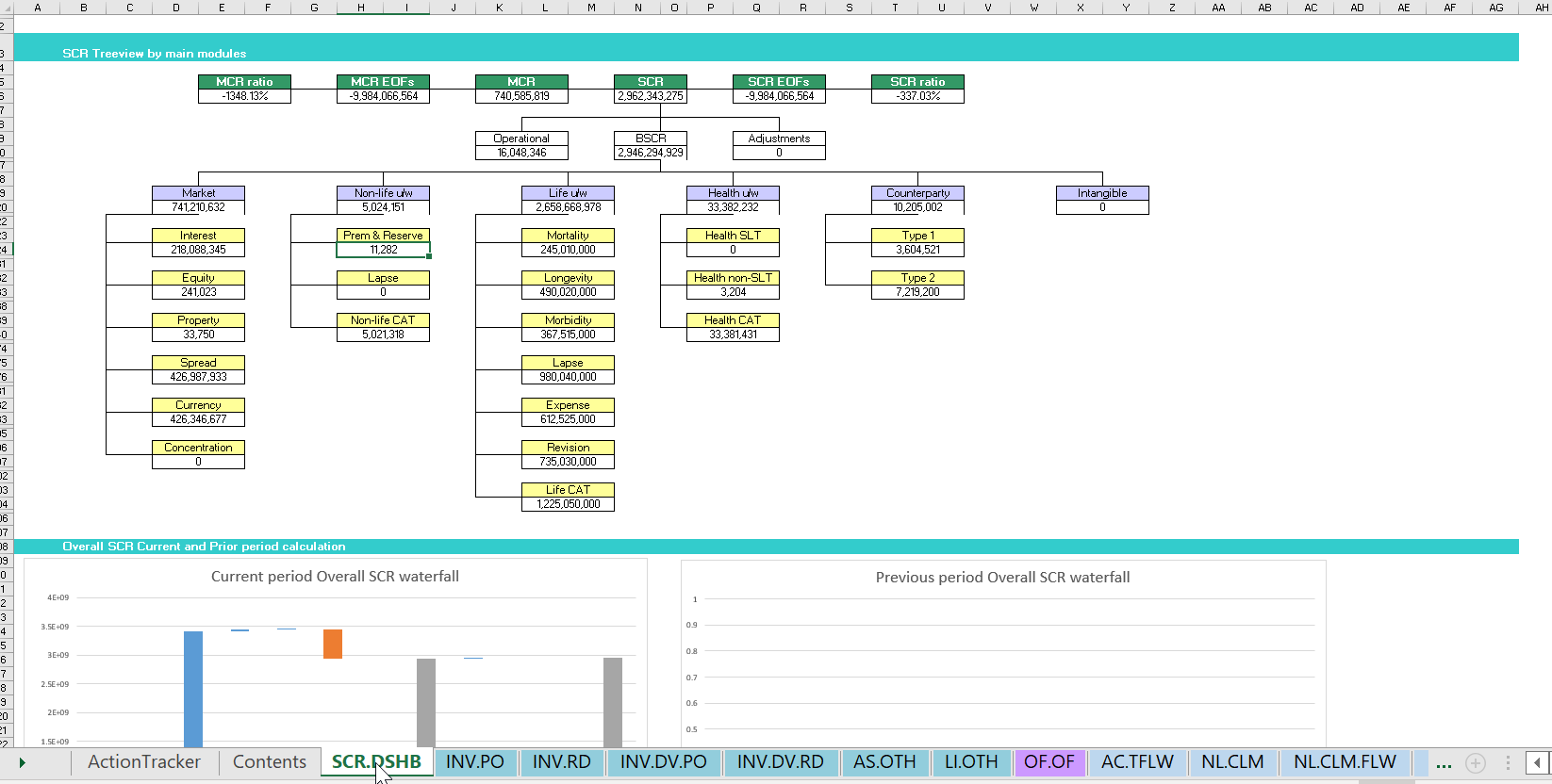

SCR MI

To assist usage of the SCR calculations module we have added a new in-built (to the return workbooks) dashboard sheet which gives a treeview summary of the SCR result and visual representations of the SCR sub-modules results. These include the equivalent charts for the prior period’s SCR results (brought into the return via the roll-forward, H.HV mechanism).

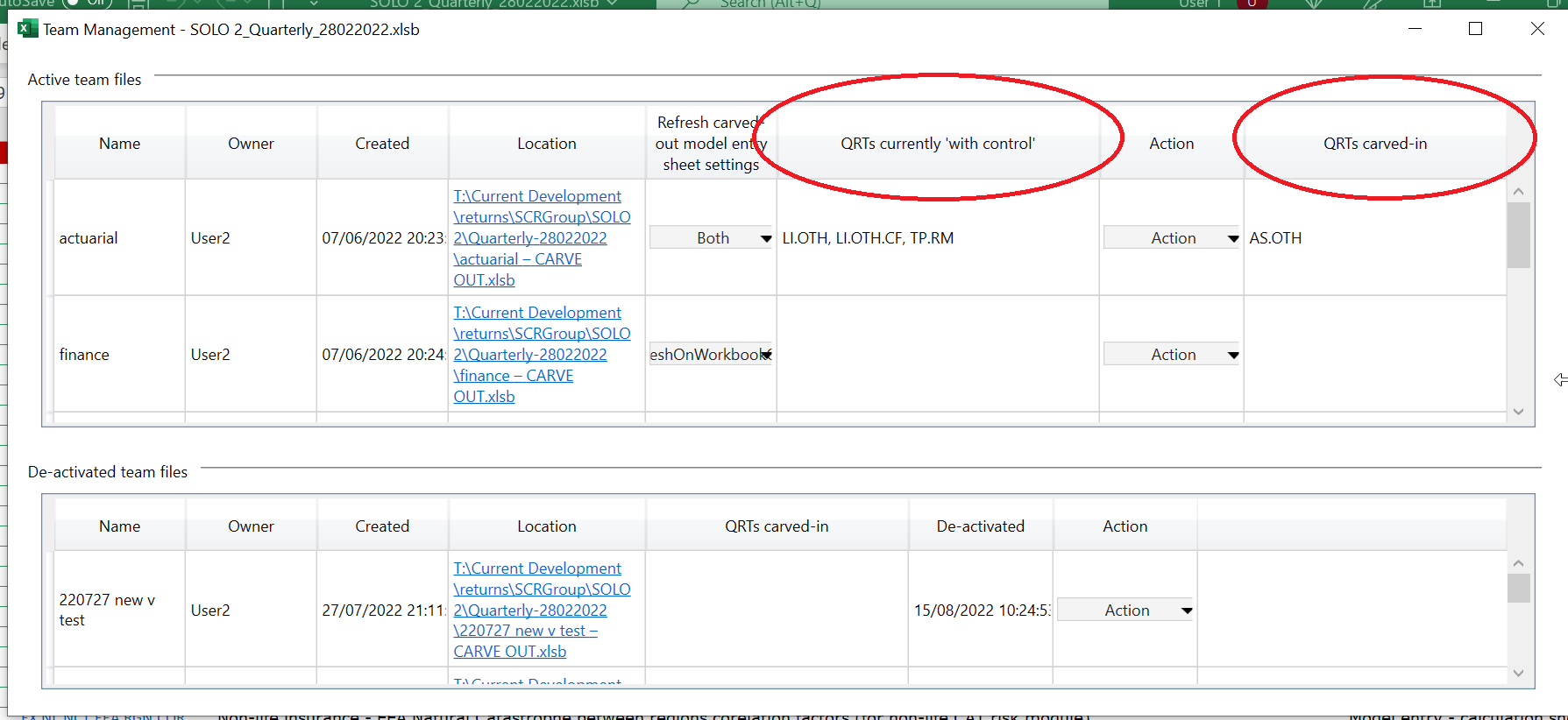

Better support for simultaneous SCR calcs users

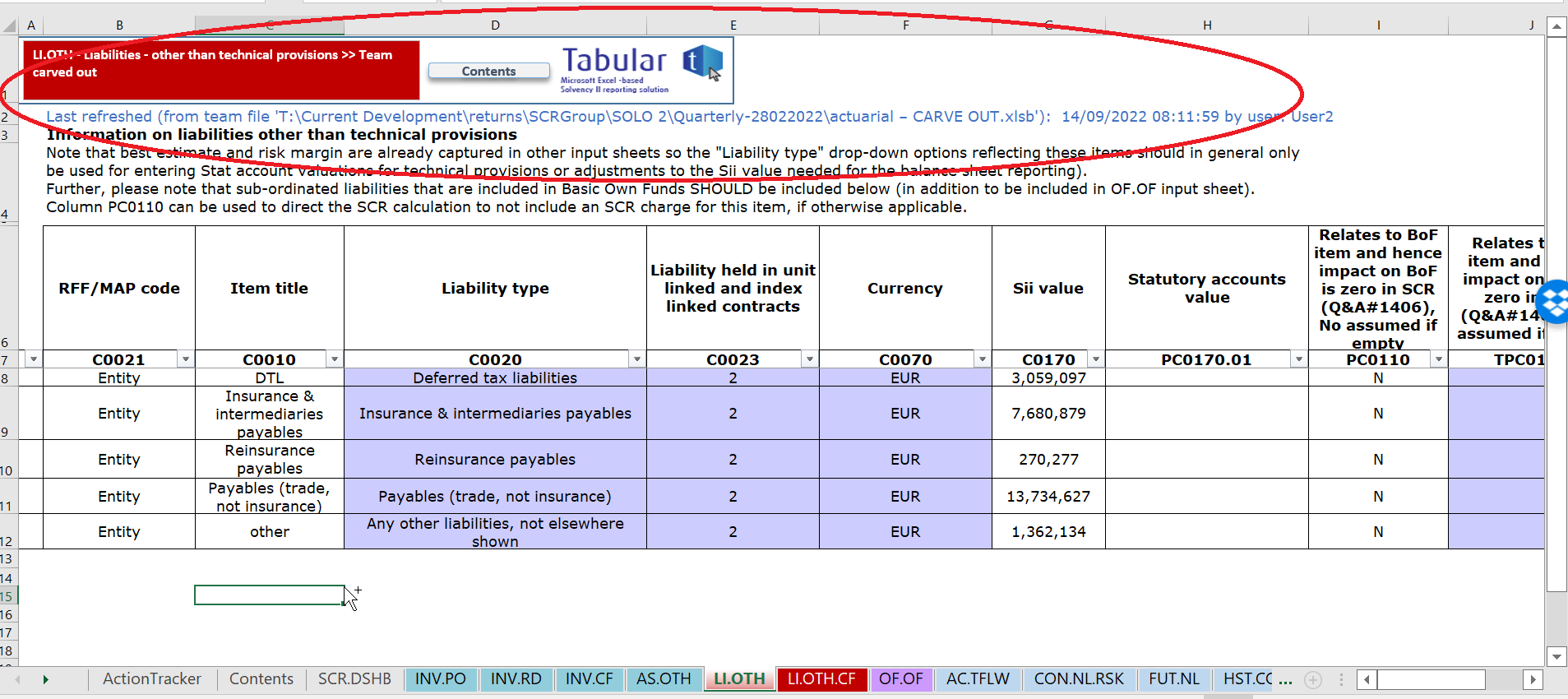

Users can now setup automated imports into their team files of the latest (model entry) data from other team files. There are new configurations available in the Team manager window which allows you to choose when a carved-out sheet in a team file is refreshed. These options are: on workbook open only; on sii model refresh only; both of these or neither (ie never automatically updated). There is also the option in manually trigger the refresh in Tools menu.

Whenever a model entry sheet has been refreshed via this mechanism (either through an automatic update or manually invoked), the sheet will indicate this and when in the top row of the sheet:

Explicitly supporting supplementary insurance

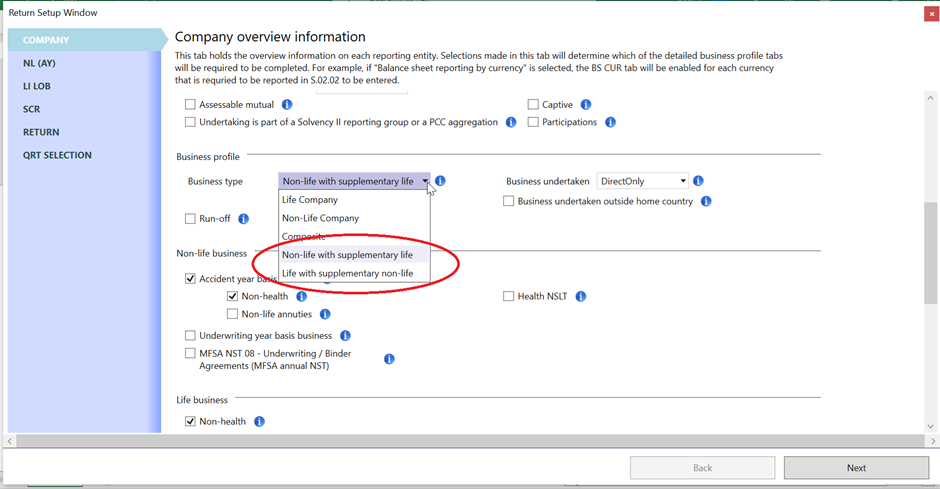

We have now added support for a case where Tabular had not previously accounted for 100% correctly; insurers which are not authorised as composites (i.e. they are authorised as non-life insurer or life insurer) but they write both life and non-life business e.g. non-life (authorised as such) insurer with supplementary life insurance cover that is “supplementary” to the non-life cover and does not require additional life insurance authorisation (as would be the case for a “proper” composite).

To cover this case properly in the system (i.e. so that users no longer need to make any manual adjustments to the set of QRTs in the returns and calculated amounts e.g. the absolute floor of MCR in S.28) we have added two new options in the Company type list.

So, in addition to life, non-life and composite there is now: “non-life with supplementary life” and “life with supplementary non-life”:

General improvements to Team functionality

More flexibility for the general usage of Team, including:

– you can now Carve-in a specific QRT without needing to close (which is now renamed as “De-activate”) the whole team file. The radio buttons below allow you to chose whether (after carving-in the selected QRTs) you wish to keep the Team file active or de-activate)

Thus uers now have some more flexibility to carve-in the QRTs as and when they are ready (instead having to wait for all to be ready).

The main window will also now tell you for each team file which QRTs have been-carved in (the [QRTs carved-in] column on the right of the below screenshot) and which are still currently carved-out (With Control) in the file:

You will also have the flexibility where you can carve-in a QRT but then carve-it out again to the same team file if it needs some further adjustments. For example (as shown in the above with AS.OTH) a QRT can appear in the [QRTs carved-in] column as well as the [QRTs currently with control] for a team file

– There is a new option, “Import without carve-in” which is to cover cases where you want to bring in data from the team file without necessarily wanting to carve-in the data.

– There is another new option, “Re-active” which you can run on any de-activated (i.e. Closed) Team file and once this is done you can re-use that file same as any created and not de-activated Team file. This will avoid scenarios where previously if you closed a Team file you had to create a new one from scratch (potentially losing notes, formatting etc. in that old team file)

7.0.0.0 Release – data updates

The inflation increase to certain defined amounts in the Directive (including the absolute floor of MCR) set out in Official Journal (2021/C 423/12) [https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=uriserv%3AOJ.C_.2021.423.01.0025.01.ENG&toc=OJ%3AC%3A2021%3A423%3ATOC] is implemented. Note:

– this take effect for reference dates 20th October 2022 and later

– this does not change for UK and Gibraltar regulated insurers (the AFMCR, and other, amounts)

The transitionals for UK (and Gibraltar) insurers post-Brexit [https://www.bankofengland.co.uk/eu-withdrawal/transitioning-to-post-exit-rules-and-standards] expired and Tabular has been updated to remove those transitionals for reference date after the expiry date.

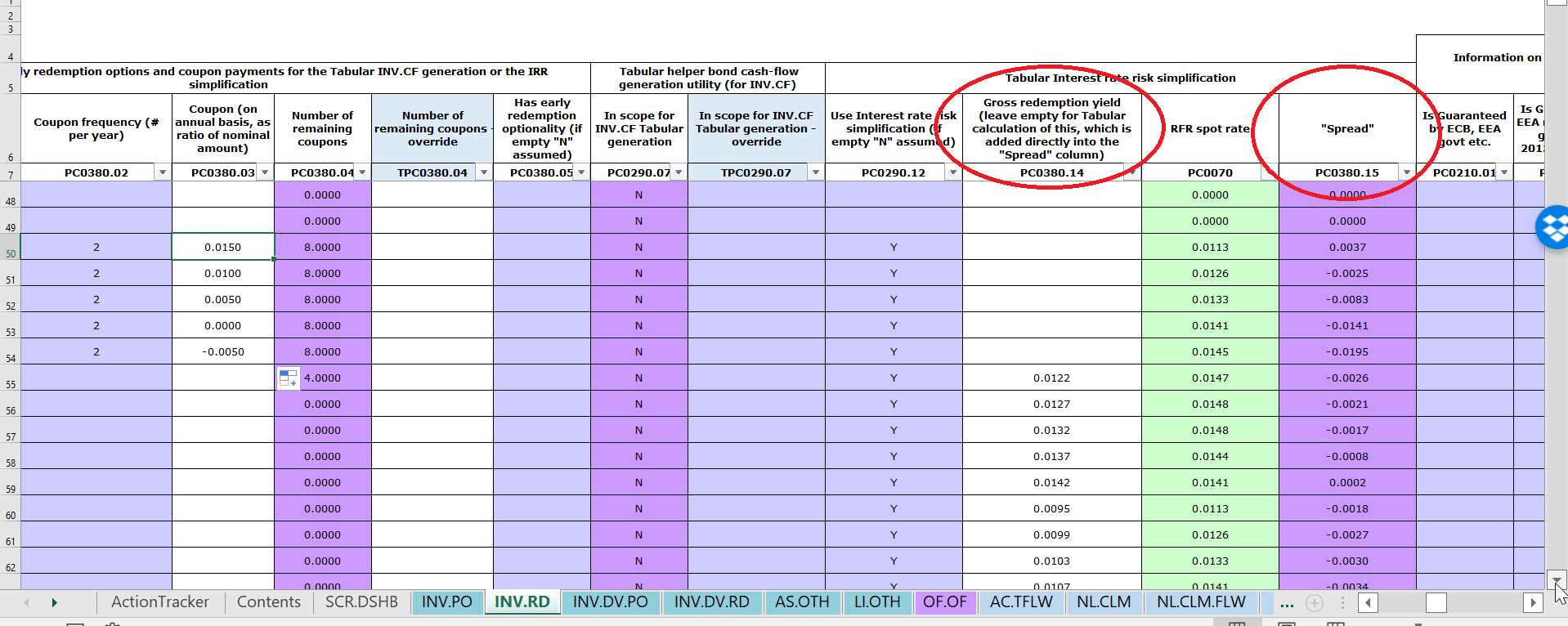

Added support for Tabular to calculate the “Gross redemption yield” input for the asset duration-based simplification for the interest rate risk module. If this option is selected for an asset and the gross redemption yield is left empty the “Spread” for the asset is automatically calculated:

Corrected a problem with the “Period start” field in MFSA (Malta) NSTs where the month and day of the date was incorrectly switched in some circumstances.

To support a more accurate calculation of the “reference undertaking” in the risk margin calculations, the model entry input sheet for reinsurance CPD exposures has been expanded to allow separate input of the CPD adjustment for expected default for non-life and life insurance.

Following the de-activation of EIOPA validation BV372 (which reconciles S(E).02.01 R0200 “Deposits other than cash equivalents” with S.06.02) to no longer include CIC79 within this relationship, we have added a temporary (until taxonomy 2.7) non-xbrl based formula to S(E).02.01 R0200 which excludes CIC79.